Saving money isn’t easy. So when we make a choice that saves us tons of money, we should celebrate! It also helps to hear other people’s money wins, so we can emulate them and make similar life changes.

One user of the popular Frugal community on Reddit wanted to do just that. He asked members to share their proudest frugal moments.

Treatment

Mental illness causes many problems, but many ailments lead to impulsivity, reckless behavior, or the inability to maintain a job. These behaviors can wreak havoc on finances.

One user shared that their biggest frugal win was getting treated for ADHD.

“No more impulsive spending. No more poor planning,” they shared.

Driving it To the Bitter End

Most frugal folks avoid overspending on new cars by keeping their vehicle for as long as possible. One user said their proudest moment was strict adherence to that policy.

They kept their car for 14 years and over 300,000 miles.

Other users jumped into the thread to boast about how many miles their current cars had, hoping to beat the 300,000 someday.

Cycling

Cars are expensive. Anything you can do to avoid spending money on gas, maintenance, insurance, and monthly payments is a frugal win.

One Redditor switched to cycling, saying it saved them a ton of money while improving their quality of life.

Others said they’d love to switch, but cold, brutal winters make car ownership imperative.

Expensive Items Up Front

Frugal isn’t the same as cheap. Sometimes it’s more cost-effective to splurge on an expensive item than remain unsatisfied with a more affordable version.

A community member learned this the hard way when they collected cheaper versions of the expensive item they wanted. They were buying the cheaper item to fill a void that could only be filled with the thing they really wanted. Ultimately, they learned they’d spend less in the long run if they simply invested in what they wanted.

Marry the Right Person

Relationships are hard. Far too often, spenders partner up with savers, leading to resentment and hurt feelings.

If you marry someone on the same page regarding spending, saving, and life goals, your life will be far easier.

“It’s so easy to save when everyone is working and paying their fair share,” said one user.

Cut Your Own Hair

Salons and stylists cost a pretty penny, and you can save all that if you learn to do it yourself.

“I’m pretty proud of the fact that I’ve learned to cut and bleach my own hair,” stated one user, adding that her curly hair is super expensive to style in salons.

Master Stock

Store-bought stocks aren’t budget busters, but they are full of unnecessary sodium. Making your own saves you a few bucks in stock prices and prevents food waste, so it’s a double win.

One user was proud of themselves for learning to use vegetable scrappings, chicken skins, and unusable meat cuts to make their own stock.

Simply freeze the ingredients until needed, and freeze any leftover stock.

Trade Rent for Services

A clever user said their proudest frugal moment saved them thousands of dollars in rent money over the long haul. They agreed to keep the shared house clean in exchange for a much lower rent payment.

“I saved thousands of dollars over 4 years doing this,” they boasted, adding that they enjoyed cleaning anyway, so it was a perfect arrangement.

The Best Teacher

The internet brought a universe of possibilities to the common folk. Youtube has become our master, our teacher, and our best friend.

Many users explained how they use Youtube for everything, saving them thousands of dollars in professional services.

One user listed all the things they learned on the platform: “Cut my own hair, install a new faucet, build or refurbish furniture, repair a wall, make cement pots, learn how to sew from scratch, use affiliate codes for discounts, meal prepping, get better at parallel parking, repair a hanging electric outlet,” they shared, adding there’s a Youtube for nearly anything you want to learn.

Local Veggies

Skip the vegetable section at your local grocer. Shop farmer’s markets and local produce stands instead. One user said they’re much cheaper, and others added the quality is way higher.

It’s a frugal win that’s as tasty as it is cost-saving!

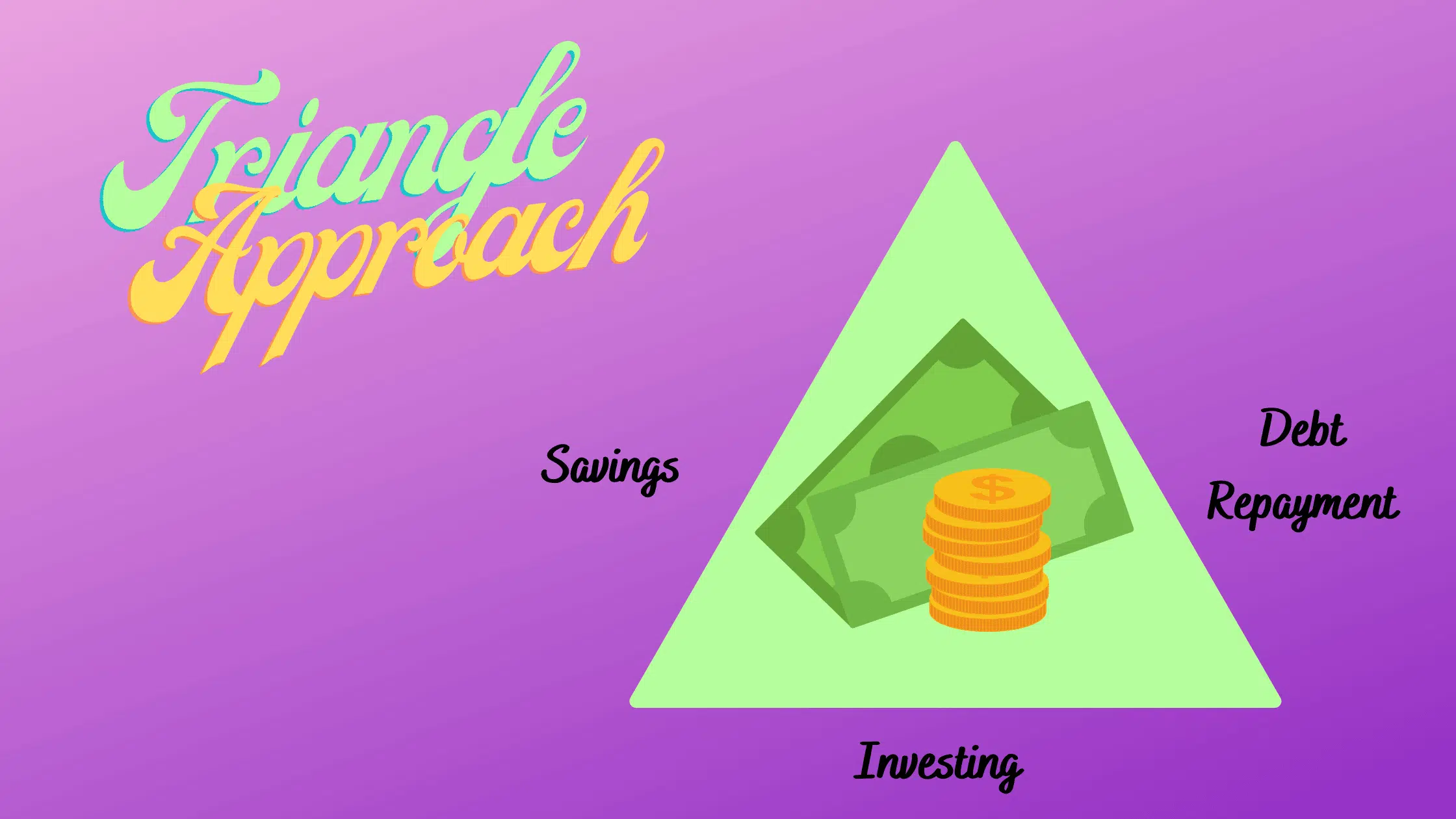

Use the Triangle Method To Achieve Your Goals

Should you save, invest, or pay off debt? Gurus have tons of different answers, but the triangle method works for everyone.

Save Money on Basic Living Expenses

You have to live, but it doesn’t have to cost a fortune. Here’s how to save money on living expenses.

Source: Reddit