Every financial expert has a different opinion on what you need to do to achieve your financial goals. They will shout these ideas into the void, claiming anyone who doesn’t follow their way is doing it wrong and likely to lose out in the financial game.

Most of these experts are wrong. They want you to follow their method because it makes them money, not because it helps you.

A Money Management Method that Works

I developed the Triangle Approach to personal finance to help real people manage their money and achieve their financial goals. And although I could write a book about it (maybe someday I will), I’m giving you the short and sweet of everything you need here, for free.

Discover how the Triangle Approach works, and why it *might* be the best way to approach your financial goals.

*I say “might” because, unlike those finance bros who scream that it’s their way or the highway, I understand that different people need different things. Although the Triangle Approach will work for most people, I acknowledge that it might not work for all, and that YOU need to do whatever works for you.

What’s the Triangle Approach?

The Triangle Approach is a unique way of approaching personal finance based on the three main pillars of money management: Saving, Investing, and Debt Repayment.

We developed the Triangle Approach because current financial advice is lacking. You’ll find experts of all stripes with different opinions on how to approach these three pillars. Some will scream that you must pay off every cent of debt before opening an investment account, while others will shout that you must have 6 months of emergency savings before doing anything else.

Our Triangle Approach is different. It allows users to view these three pillars from a personal lens and make adjustments based on their individual goals and priorities – something no other financial guru even considers (at least online).

Why Triangles?

We love triangles, first because we love math 🤓, but also because it’s the perfect shape to represent the three pillars of finance, and there’s so much versatility.

Think of all the different types of triangles. Equilateral triangles boast three equal sides. Isosceles triangles have two equal sides, but the third side can be either longer or shorter. Millions of triangles have three different sides.

Trigonometry aside, triangles fit because the three sides represent the three main pillars of financial goals. One side represents your savings, another investing, and the third your debt repayment.

Why All Three?

The point of a triangle is to showcase that the three pillars of finance are all crucial to proper money management. To be financially secure, you must invest, save, and pay off debt. A triangle helps you visualize those three staples of personal finance and allocate money to all three pots.

I know what you’re thinking.

That’s not what the experts say!

And you’re right.

Pay Off Debt Before Investing

The biggest trope in finance is that you should pay off all your debt before investing. Although mathematically, it makes sense if you carry high-interest debt, the advisors pushing this advice fail to realize that life isn’t about perfect math. Things get messy, emergencies happen, and even the best plans can go south.

It can take years to pay off all your debt. If you aren’t investing and saving at the same time, you lose out on the number one commodity for growing money. If you wait ten years to start investing because you’re hyper-focused on paying off debt, you will lose out on ten years of compounding interest and reinvested dividends. You’ll never get that time back.

Save $1000 in an Emergency Fund First

Another standard piece of advice is to save $1000 in an emergency fund and then put all your extra money towards debt. Unfortunately, this advice hasn’t changed in a decade, and in recent years, I haven’t met an emergency that costs less than a grand.

If you only have $1000 saved, one financial crisis can destroy all your work, whether adding more debt because you didn’t have enough money in savings to cover the emergency, or starting from square one because you had to completely wipe out your emergency fund.

The Triangle Approach Avoids the Pitfalls

The triangle approach seeks to avoid these pitfalls by highlighting the importance of all three pillars and allowing you to build a triangle that works for your financial situation.

It shows you that you can put money towards debt repayment while funneling money towards savings and starting your investments.

How To Use the Triangle Approach

The triangle approach is as simple as it is practical.

Visualize your three pillars as sides to a triangle. Each side is important because you wouldn’t have a triangle without any of them. It’s this one point that many financial advisors will refuse to admit.

I don’t entirely blame them. When trying to get your finances in order, it’s sometimes easier to focus on just one thing than on three different things at once. Three can be overwhelming.

However, the harsh truth is that all three are vital to your overall financial well-being and security. Putting them into a triangle can help you see how the three are related.

The triangle also showcases that it’s not really three different things. Each side is a component of one vital aspect of your life: financial security.

How Should I Build My Triangle?

The beauty of the Triangle Approach is that you can decide how to build your triangle based on your personal goals and priorities. Here’s what you need to consider when crafting it:

- Financial Goals

- Budget

Determine Your Financial Goals

The Triangle Approach is based on your financial goals. Therefore, it’s imperative that you sit down and figure out what you want from your money before building your triangle.

Determining your financial goals is a personal journey. Everyone wants something different out of life. Some want to retire early, while others prefer to coast to retirement. Some people don’t care about money as much, but don’t want to be beholden to credit collectors or have debt hanging over their heads.

Discovering what you want out of life is critical to your journey. Take some time to figure it out.

Build Your Budget

Budgets get a bad rap, but they are wonderful tools that help you tell your money where to go. Don’t think of a budget as a limit – think of it as a roadmap to achieving your goals.

A harsh truth about life is that there are always bills to pay. Regardless of your goals, you must pay your mortgage, car note, credit card, and utility bills.

A budget will help you determine how much money you need to survive and thrive, then showcase what’s available for your triangle.

But you also must remember to pay yourself first – there are a few things you need to incorporate into your budget while building your triangle.

Triangle Must-Haves

Although much of the triangle-building depends on your personal goals, there are a few building blocks that everyone should include.

First, your debt repayments from your budget should be included. The minimum payments you make towards your car note and credit card bill form a large chunk of the debt side of the triangle.

Next, if you have access to a 401K with a company match, you need to invest the minimum amount to get the match. A company match is the best investment; nowhere else can you double your money instantly with an investment. Your 401(k) should be the starting line for the investment side of the triangle.

Finally, an emergency fund is vital to financial success. Building a $1000 emergency fund should be at the top of your list of goals. However, as we discussed above, you mustn’t stop there. Just as a triangle always has three sides, you should never completely stop contributing to an emergency fund. Ideally, you will eventually grow your fund to have 3-6 months of living expenses saved. Even after that, putting away a nominal amount each paycheck to sustain the triangle will ensure that you never meet an emergency you can’t handle.

Personalizing Your Triangle

Now it’s time to personalize your triangle. This step is highly dependent on the goals you developed above.

Here are some examples to help you get started. We’ll pretend we have $150 leftover in our budget to fund our financial goals. Your sides will vary based on what you have available.

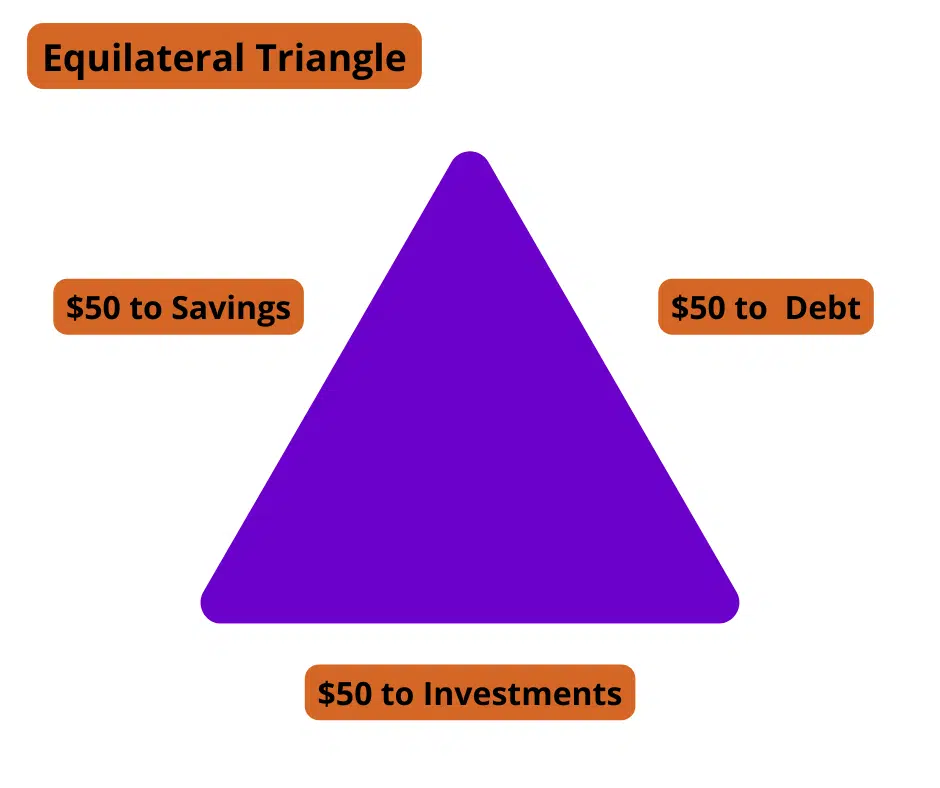

The Equilateral Triangle

Let’s say you are just starting in life and don’t have your goals wholly defined. That’s okay. It takes time to learn what you really want. An equilateral triangle may be the ideal option for you.

Put an equal amount of the leftover money towards each pillar. Investing, saving, and paying off debt in equal amounts will give you a solid foundation for when you decide what you really want.

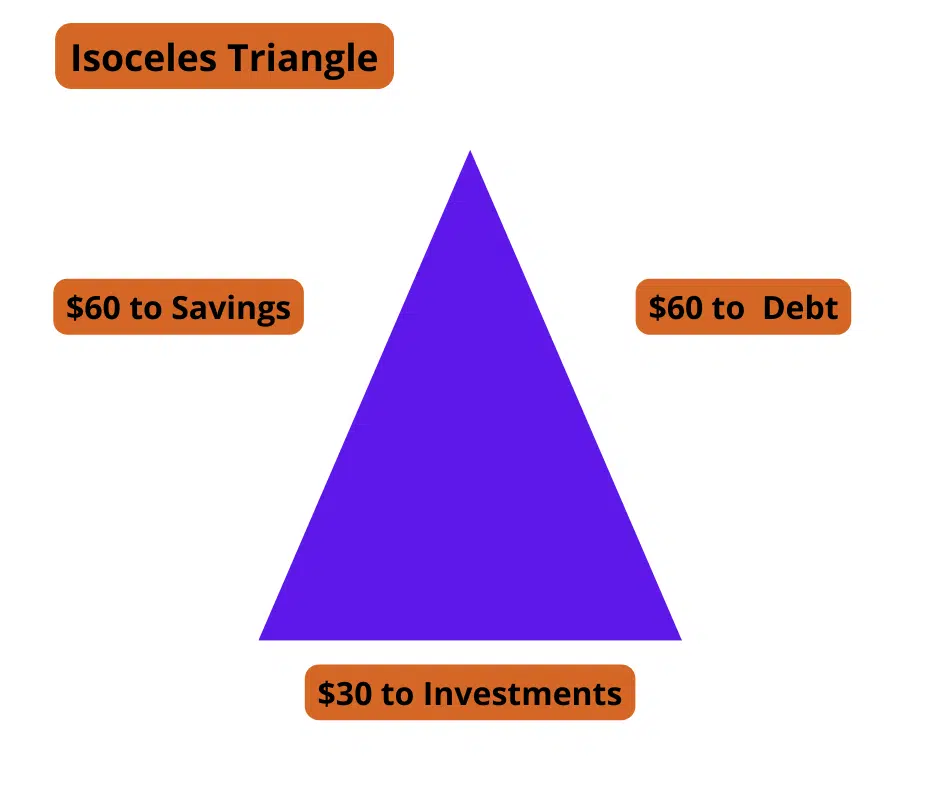

The Isosceles Triangle

An isosceles triangle has two equal sides. The third can be longer or shorter, depending on your goals.

If you have little to no debt, you may want to build an isosceles triangle with a short third side, putting equal amounts of money into saving and investing while only putting a nominal amount towards debt repayment. If you have a fully-funded emergency fund, you may want the third smaller side to be savings, only putting a tiny amount towards savings accounts each month while aggressively investing and paying off debt.

Alternatively, you could make the third side the large side. If you don’t have a solid emergency fund, you might want to make an isosceles triangle with a large hypotenuse representing your savings. The bulk of your extra money will go towards building your savings up, while smaller amounts go towards investing and debt repayment.

If you’re obsessed with becoming debt-free, make the larger side debt repayment, while funneling a small amount to investments and savings.

The beauty of the Triangle Approach is that it works for almost any goal.

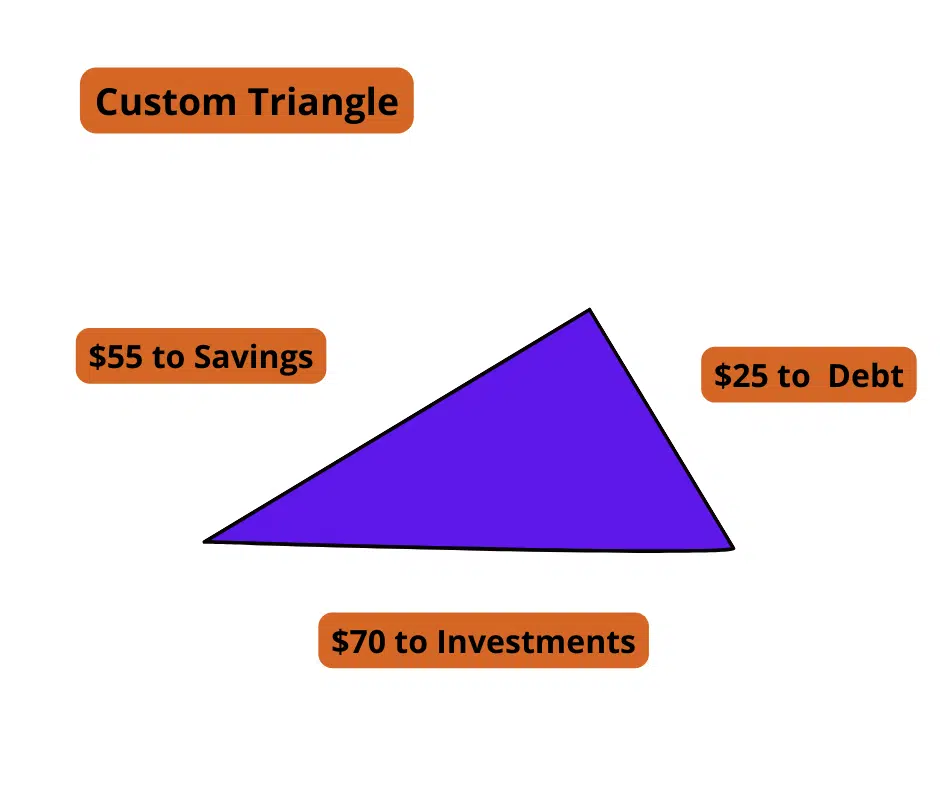

Three Different Sides

Many triangles feature sides of varying lengths, and you may want to build your triangle this way, depending on your financial goals.

If retiring early is your number one goal, you probably want investing to be the most prominent side of your triangle. With a fully funded savings account, you don’t have to put much more into savings, so your second priority can be debt repayment. You may end up with an acute triangle with two fairly long sides and one short side.

Special Considerations

You may have unique financial circumstances that make it harder to apply the triangle. Perhaps you have no debt or have a fully funded emergency account.

The triangle still applies!

Let’s say you are completely debt-free. You may think that you don’t have to worry about the debt side of the triangle. However, consider using that side to create a fund for large purchases that could put you in debt. You may need a new car one day, so consider putting your “debt” side of the triangle into a fund earmarked for a new vehicle when required.

The Triangle Method Isn’t for Everyone

Many people have developed their own systems for managing their finances, and if you have something that works for you, no worries! Personal finance is personal, and you need to do what works.

The financial triangle helps folks overwhelmed with personal finance and confused about all the different advice thrown at them daily. It might not be suitable for everyone, but it does help people visualize their goals and ensures they consider all their financial goals while managing their money.

Not a Financial Advisor

As a disclaimer, I must mention that I am not a financial advisor, and I’m definitely not YOUR financial advisor. The best option for those who need help with their money is to see a certified fiduciary who will guide them towards achieving their goals. Wealthtender is a fantastic resource to help you find a financial advisor near you.

However, in practice, I understand that not everyone can afford a financial advisor, and many people need help. Although I’m not an advisor, my primary goal is to help everyone get ahead.

The Triangle Approach helped me achieve the majority of my financial goals. It helps users develop a balanced approach to financial management when they can’t afford an advisor.

The Triangle Approach is not meant to be financial advice or investment advice. It’s simply a money management approach.